Diversifying Structures in Growth Notes

Trade Summary:

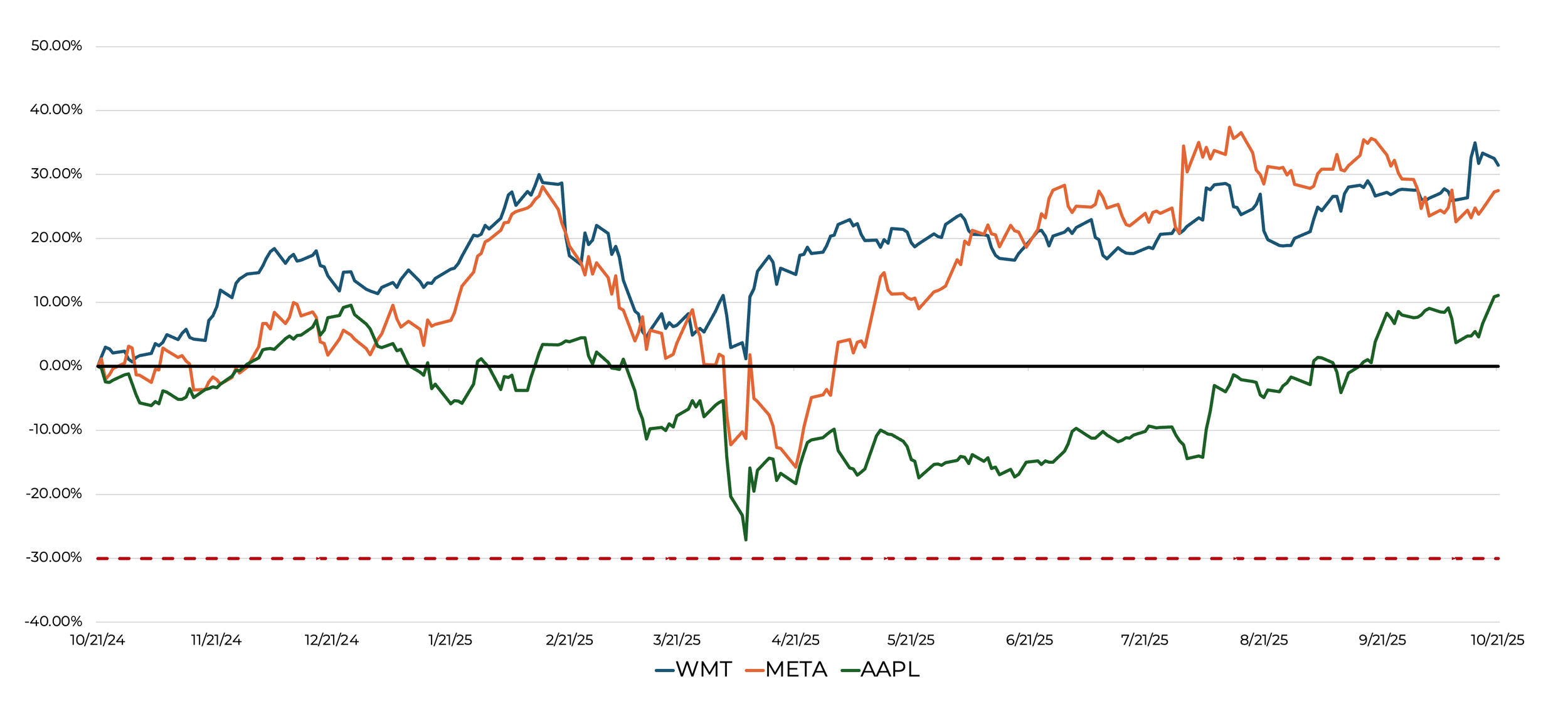

Performance & Purchase Rationale: Purchased on October 21, 2024, the WMT–META–AAPL Catapult Note was designed to capitalize on diversified growth exposure while benefiting from the accelerated return mechanics of a catapult structure. By combining Walmart’s defensive stability with the higher-beta profiles of Meta and Apple, the note balanced sector risk while preserving meaningful upside potential. As of its call on October 21, 2025, the note delivered a 67.4% payout—an outcome that reflects both the effectiveness of the underlier mix and the advantage of using a catapult structure to amplify returns once performance thresholds are met.

Conclusion:

This case underscores how thoughtfully constructed catapult notes can enhance total returns while reinforcing disciplined capital rotation. The early call freed capital ahead of schedule, allowing us to reallocate into higher-conviction opportunities without sacrificing the gains achieved. As part of our broader growth framework, this note demonstrates how active management and diversified structure design work together to maximize long-term, risk-adjusted outcomes.

Past performance is no guarantee of future results

Why We Highlighted This Note:

We selected this note as our Highlighted Note of the Month because it exemplifies the strategic value of diversification within structured growth notes. The one-year call aligned well with our preference to reduce exposure at stretched valuations while recycling gains into new opportunities. Importantly, the note didn’t require perfect performance from all three names; instead, the structure allowed upside capture through balanced contributions—a feature that helped turn a strong idea into an efficient early-appreciation outcome.